Lending Use Case

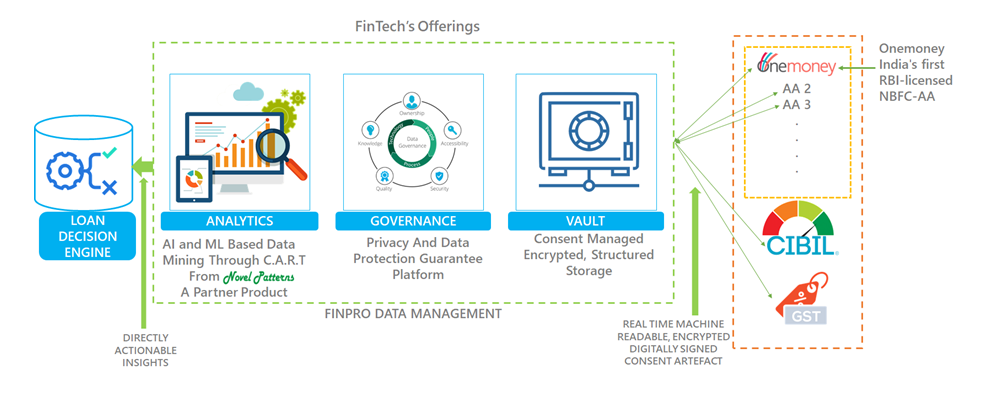

Functional Schematic For The Lending Use Case

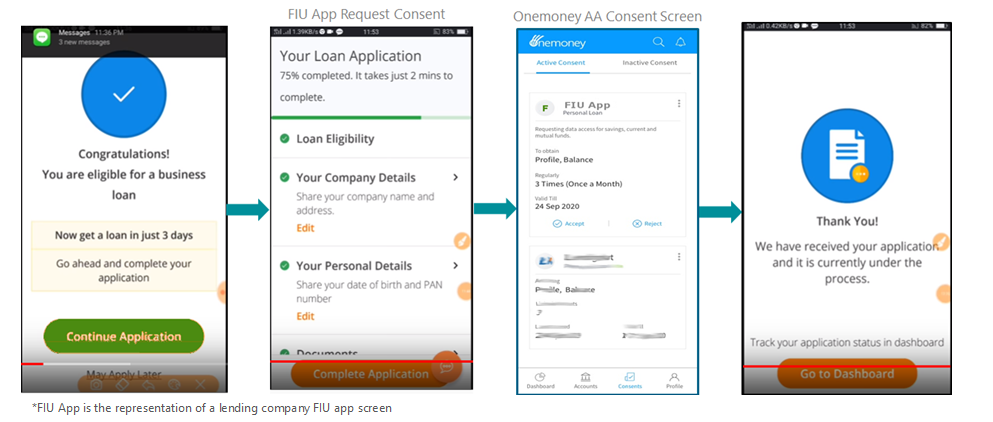

User Journey For A Lending Use Case

The user journey described below considers the use case of an existing user who has previously signed up with the Onemoney Account Aggregator before accessing the partner lender’s mobile application.

The journey starts with the customer providing her permission for the app to access her contacts, location, etc. Once the customer provides the required permissions, she provides basic personal and business details to check eligibility. On knowing her eligibility for a business loan, she completes the loan application by providing personal details, company details, and business details. An option then displays to the customer to choose an Account Aggregator to share her bank transactions data among other options. The customer chooses Onemoney Account Aggregator, enters her Onemoney Id and clicks on the submit button. This initiates a consent request. At this point, an inter-app call is made, and the user is re-directed to the Onemoney Android application. The customer logs in with her Onemoney credentials and approves the pending Consent request. On approval, the customer is redirected to the partner’s lending app. The customer is then shown a confirmation page that her application has been submitted successfully.

Note: On approval of consent, a data request is placed by the FIU application from the backend to fetch the customer‘s data from the FIP for credit decisioning and approval.

Lending case journey illustrated below: